简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

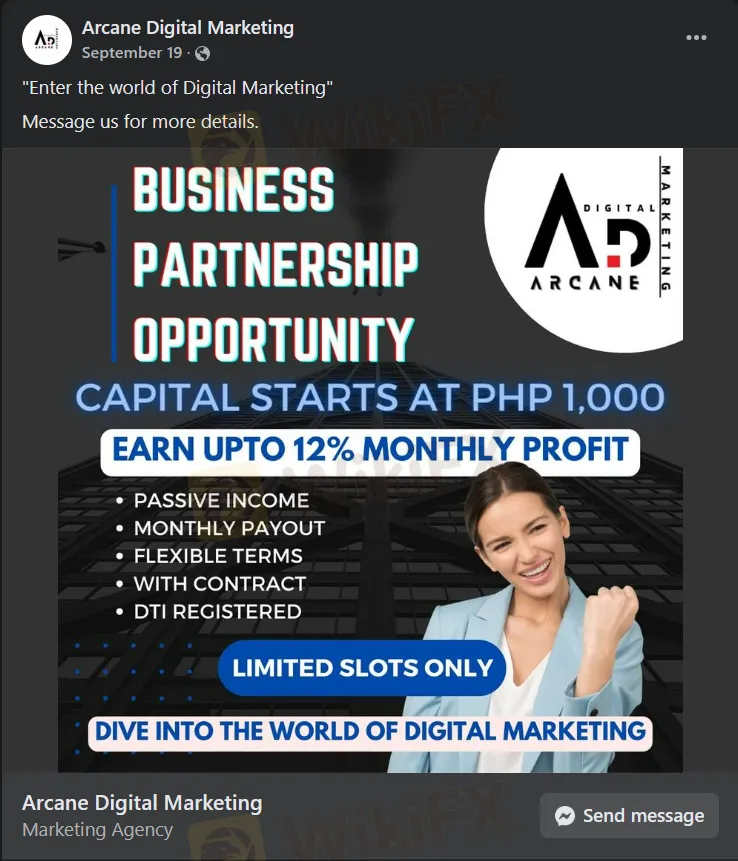

PH SEC Warned ARCANE DIGITAL MARKETING for Unauthorized Investment Activities

Abstract:The Philippine Securities Commission has warned against ARCANE DIGITAL MARKETING for conducting unauthorized investment activities. The company, which operates online, entices public investments with promises of 12% to 45% profits in 45 days on a minimum investment of Php1,000.00. These activities, resembling securities under the Howey Test, are unregistered and illegal. ARCANE DIGITAL MARKETING is not a registered corporation or partnership and lacks legal authorization for such activities, violating the Securities Regulation Code. The public is advised against investing and to report suspicious activities.

The Securities Commission of the Philippines has issued a critical warning against ARCANE DIGITAL MARKETING, an online entity found to be conducting investment activities without the necessary legal authorization.

Investigations reveal that ARCANE DIGITAL MARKETING, an emerging social media platform, is luring the public into investing a minimum of Php1,000.00. They promise high returns between 12% to 45% profit in just 45 days. However, this enticing offer is not legally sanctioned.

The investment packages proposed by ARCANE DIGITAL MARKETING resemble securities, as defined by the Howey Test. They require no effort from investors other than the initial financial contribution, expecting a profit in return. Such activities involving securities must be registered with the Commission, which ARCANE DIGITAL MARKETING has failed to do.

The company is neither registered as a corporation nor a partnership with the Commission. Moreover, they lack the authorization to solicit investments from the public or issue any investment contracts and securities. This is a clear violation of the Securities Regulation Code, specifically Sections 8 and 12.

The public is strongly urged NOT to invest or continue investing in any scheme offered by ARCANE DIGITAL MARKETING. Investments in unregulated entities carry significant risks, as they do not adhere to the necessary investor protection standards and market conduct requirements.

The Commission is also issuing a stern warning to individuals and entities involved in the promotion, sale, or recruitment of ARCANE DIGITAL MARKETING. Participation in these unauthorized activities could result in severe legal consequences, including penalties and imprisonment, as stated in the Securities Regulation Code and the Financial Products and Services Consumer Protection Act (FCPA).

Additionally, the Commission will report the names of all involved parties to the Bureau of Internal Revenue (BIR) for appropriate penalization and tax assessment.

The public is encouraged to report any suspicious investment solicitation activities related to ARCANE DIGITAL MARKETING to the Commission's Enforcement and Investor Protection Department at epd@sec.gov.ph.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Tighter Scrutiny: Finfluencers Face Global Crackdown Amid Rising Risks

The UK’s Financial Conduct Authority (FCA), in collaboration with eight global regulators, has taken strong enforcement actions against unauthorised finfluencers. The move signals a broader regulatory shift toward stricter oversight of financial promotions on social media.

Interactive Brokers Enhance Account Security with FDIC Coverage

Interactive Brokers now offers up to $5M FDIC insurance for individual accounts, boosting protection on cash held in brokerage accounts starting May 2025.

Exnova Forex Broker Scam: Blocked Accounts, Lost Funds

Exnova forex broker slammed for scam tactics, blocking withdrawals, and dodging regulation. Victims warn of fraud risks—steer clear!

TriumphFX Rebrands to Continue Global Fraud: Over RM80 Million Lost

The notorious forex investment company TriumphFX, previously exposed for running a global scam operation for over a decade, is now being accused of rebranding itself to continue defrauding unsuspecting investors. Despite being unregulated and based offshore in Seychelles, TriumphFX has actively targeted Malaysian investors, luring them with false promises and eventually converting funds into cryptocurrency, making recovery nearly impossible.

WikiFX Broker

Latest News

IronFX Broker Review 2025: A Comprehensive Analysis of Trustworthiness and Performance

OctaFX Flagged by Malaysian Authorities

OctaFX and XM Trading Platforms to Be Blocked in Singapore

Nonfarm Data Lifts Market Sentiment, U.S. Stocks Rebound Strongly

ATFX Opens New Office in Cape Town's Portside Tower to Expand in Africa

Tighter Scrutiny: Finfluencers Face Global Crackdown Amid Rising Risks

Interactive Brokers Enhances PortfolioAnalyst with New Features

Why Your Worst Enemy in Trading Might Be You

Errante Broker Review

Currency Hedging Practices and How They Protect Traders' Interests

Currency Calculator