简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Why a Broker’s Customer Service Matters More Than You Think

Abstract:Many traders focus on regulation when choosing a broker. While this is important, it is not enough. A broker's customer service can be just as vital. If you cannot reach support when you need help, it could lead to problems.

Many traders focus on regulation when choosing a broker. While this is important, it is not enough. A broker's customer service can be just as vital. If you cannot reach support when you need help, it could lead to problems.

Responsive customer service is not just a bonus; it is a sign of reliability. A broker that answers questions quickly shows they care about their clients. They help resolve issues like login errors, deposit delays, or sudden changes in trading conditions. On the other hand, brokers that fail to respond on time can leave traders stuck. This affects not just their trading performance but also their peace of mind.

Poor customer service can also violate traders rights. When issues are ignored, traders lose time and money. For example, if a trade gets stuck due to a technical glitch, every second counts. If the broker does not act fast, the trader may face losses. Over time, this could ruin their trading account.

Many traders underestimate this risk. They think regulation is the only thing that matters. But even regulated brokers can have slow or unhelpful support. This is why traders must do more research before choosing a broker.

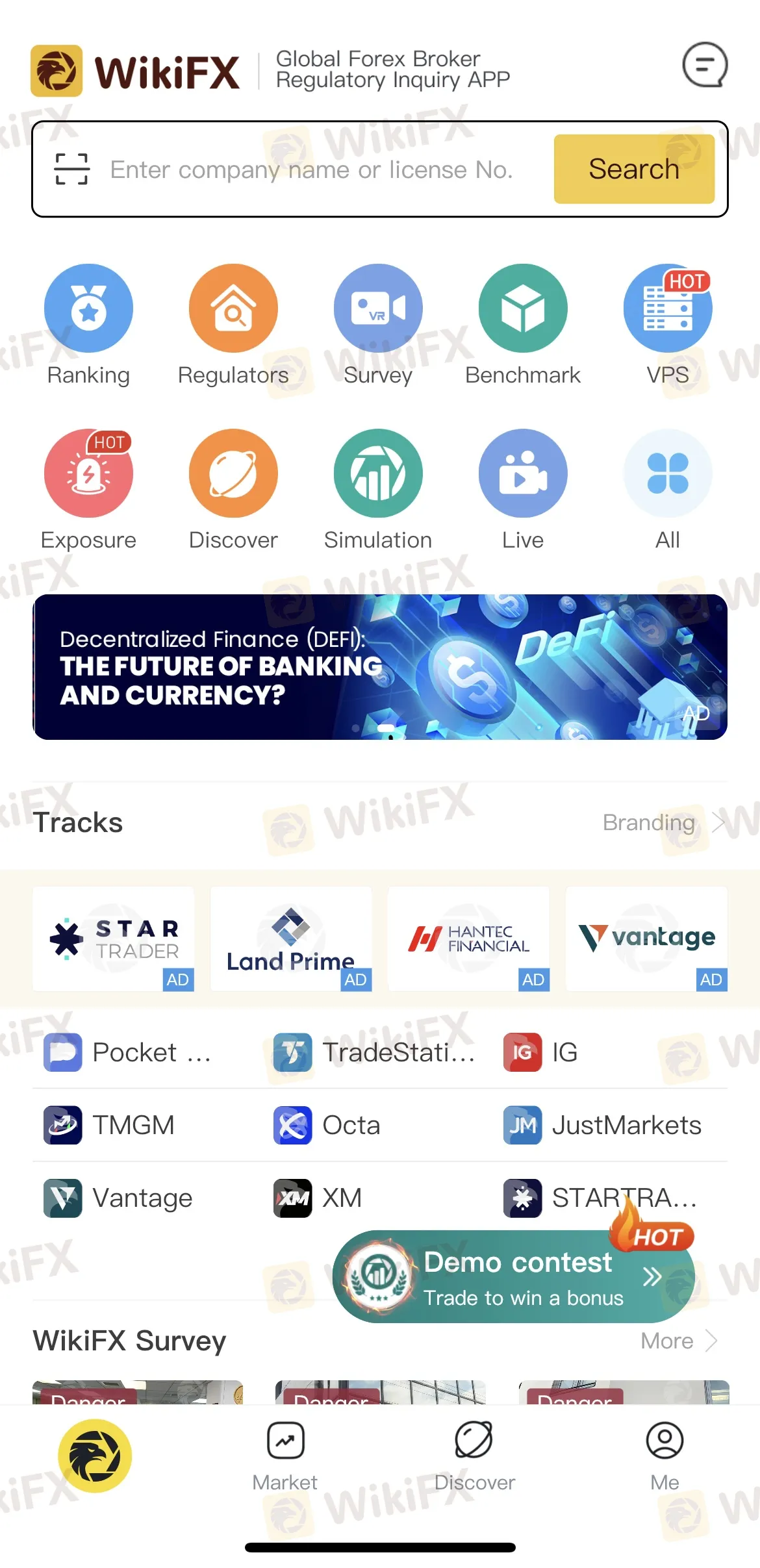

One of the easiest ways to check a brokers reliability is by using the free WikiFX mobile app. This app provides detailed reviews and ratings of brokers. It also shows whether a broker is regulated. More importantly, traders can see feedback from other users about customer service. This information helps traders make a better decision, at no cost.

Choosing a broker is a big step. Traders should not rush this process. A reliable broker with good support can make a huge difference. They can protect traders from unnecessary risks and help them perform better.

In conclusion, dont ignore customer service when picking a broker. A lack of support can lead to problems and even losses. Take the time to research brokers carefully. Use tools like WikiFX to check reviews and ratings. This simple step can save you a lot of trouble.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Interactive Brokers Enhance Account Security with FDIC Coverage

Interactive Brokers now offers up to $5M FDIC insurance for individual accounts, boosting protection on cash held in brokerage accounts starting May 2025.

Interactive Brokers Enhances PortfolioAnalyst with New Features

Interactive Brokers, a global leader in electronic trading, has released a series of powerful enhancements to its PortfolioAnalyst platform. These enhancements further empower investors with advanced tools to monitor and analyze their financial health.

SFC Issues Restriction Notice to GA (Int’l) Capital Management Limited Over Regulatory Concerns

The Securities and Futures Commission (SFC) of Hong Kong has issued a restriction notice against GA (Int’l) Capital Management Limited (GCML), raising serious concerns about the firm’s integrity, reliability, and competence in carrying out its regulated activities.

OctaFX Flagged by Malaysian Authorities

OctaFX has been officially listed on warning lists by both Bank Negara Malaysia (BNM) and the Securities Commission Malaysia (SC). These alerts raise serious concerns about the broker’s status and whether it is legally allowed to operate in Malaysia.

WikiFX Broker

Latest News

OctaFX Flagged by Malaysian Authorities

IronFX Broker Review 2025: A Comprehensive Analysis of Trustworthiness and Performance

Nonfarm Data Lifts Market Sentiment, U.S. Stocks Rebound Strongly

Interactive Brokers Enhances PortfolioAnalyst with New Features

Why Your Worst Enemy in Trading Might Be You

Errante Broker Review

Interactive Brokers Enhance Account Security with FDIC Coverage

SFC Issues Restriction Notice to GA (Int’l) Capital Management Limited Over Regulatory Concerns

WikiFX Forex Community Expert AMA

Exnova Forex Broker Scam: Blocked Accounts, Lost Funds

Currency Calculator