简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

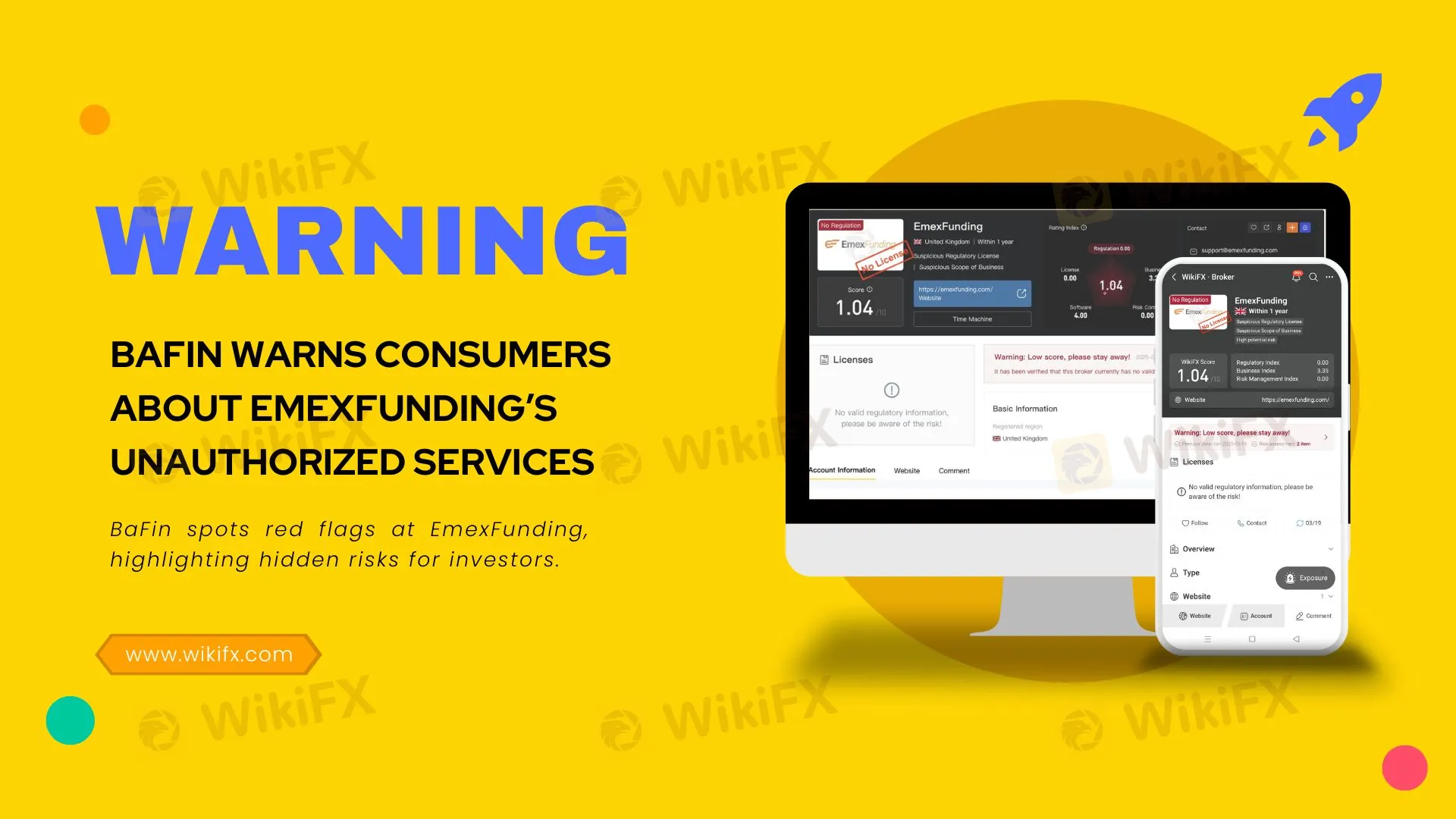

BaFin Warns Consumers About EmexFunding’s Unauthorized Services

Abstract:BaFin spots red flags at EmexFunding, highlighting hidden risks for investors.

The German Federal Financial Supervisory Authority (BaFin) has issued a critical consumer alert about the activities of EmexFunding, an unauthorized financial services provider operating through the website emexfunding.com.

BaFin's investigation revealed that EmexFunding, whose operators remain unidentified, is offering financial, investment, and cryptocurrency services without the necessary regulatory permissions. The company falsely operates under the business name “EmexFunding GmbH,” claiming its registered office is in Corby, United Kingdom. However, official records verify that such a company does not exist, indicating a clear attempt to mislead potential customers.

A significant concern raised by BaFin involves EmexFunding's promotion of a so-called “Handelskreditvertrag” (trading credit agreement). Through this misleading document, the firm encourages consumers to secure loans specifically for trading financial products and cryptoassets on its platform. Such tactics pose considerable risks, potentially leading consumers into substantial financial losses and debt.

Under German legislation—including the German Banking Act (Kreditwesengesetz - KWG) and the German Cryptomarkets Supervision Act (Kryptomärkteaufsichtsgesetz)—entities must obtain explicit authorization from BaFin to offer financial or investment-related services. EmexFunding lacks such authorization, rendering its operations unlawful and exposing investors to significant risks.

Additionally, a search conducted through the regulatory verification platform WikiFX corroborates BaFin's concerns. WikiFX reports EmexFunding as having no valid regulatory licenses and assigns it a notably low reliability rating, further emphasizing the dangers of engaging with this unauthorized provider.

BaFin strongly advises investors to perform thorough due diligence by consulting official regulatory databases and trusted platforms such as WikiFX before committing funds to any financial service providers. Engaging with unauthorized companies such as EmexFunding can result in limited legal protections and the inability to recover invested funds.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Deepening Roots of Forex Scams in India

Check out how forex scams in India have expanded beyond banks and unregistered brokers to include the informal gang racket duping investors every day.

BaFin Flags Surge in Unauthorized Financial Platforms and Identity Fraud Cases

Scammers are using cloned websites and fake licenses to trick investors. BaFin has flagged seven such entities this week. Before investing, always cross-check broker credentials on WikiFX.

$1.1 Million Default Judgement Passed Against Keith Crews in Stemy Coin Fraud Scheme

A Georgia-based federal court has passed a $1.1 million default judgment against Keith Crews on June 3, 2025, in the Stemy Coin Fraud Scheme. Read on to know more.

Forex Scam Tactics and How to Avoid Falling for Them

Forex scams have taken a vicious cycle with scammers using new and persuasive tactics to trick investors into investing in fraudulent schemes. Read more to know their tactics and how to stop falling for them.

WikiFX Broker

Latest News

Safe-Haven Surge: Gold Shines Amid Market Turmoil

Why Your Stop Loss Keeps Getting Hit & How to Fix It

Indian "Finfluencer" Asmita Patel Banned: SEBI Slaps Charges on Her Company, AGSTPL

HDFC Bank's Green Push: Empowering 1,000 Villages with Solar Energy

MetaQuotes Rolls Out MT5 Build 5120 with Enhanced Features and Stability Fixes

Advantages of Using EA VPS for Trading - Detailed Guide

$1.1 Million Default Judgement Passed Against Keith Crews in Stemy Coin Fraud Scheme

How Money Moves the World | Why Finance Matters for Everyone

IG Japan Issues Trading Alert as Israel‑Iran Tensions Escalate

Investor Alert: SEBI Introduces New UPI Safety Net Against Scam Brokers

Currency Calculator