简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What WikiFX Found When It Looked Into Exclusive Markets

Abstract:In the fast-growing world of online trading, security and regulation are essential. One company now raising questions in this space is Exclusive Markets, a broker claiming to be regulated, but scrutiny of its licence and operations suggests a more complex picture.

In the fast-growing world of online trading, security and regulation are essential. For retail investors, the choice of a broker can determine not just potential profits but the safety of their capital. One company now raising questions in this space is Exclusive Markets, a broker claiming to be regulated, but scrutiny of its licence and operations suggests a more complex picture.

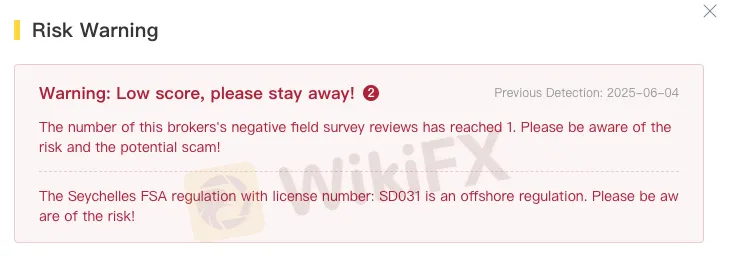

Exclusive Markets Ltd is licensed by the Seychelles Financial Services Authority (FSA), holding a retail forex licence under the registration number SD031. While this may seem reassuring at first glance, it is crucial to understand the nature of the FSA itself. As an offshore regulator, the FSA does not enforce the same stringent compliance and investor protection standards as more established authorities in Europe or North America. This makes licences issued by such offshore jurisdictions inherently weaker from an investor protection standpoint.

Further concerns were raised when WikiFX, a well-known third-party platform that monitors the regulatory status and credibility of global brokers, conducted a field investigation into Exclusive Markets. WikiFX, which aggregates licensing information from over 40 financial regulators worldwide and monitors user complaints, dispatched a team to visit the broker's listed regulatory address in Seychelles. However, the team could not locate the company at that address, leading to serious doubts about whether the broker maintains any physical presence in the country at all. (Read the full article here: https://www.wikifx.com/en/survey/948783db5b.html)

The inability to verify a physical office presence raises immediate concerns about transparency and accountability. According to WikiFXs findings, Exclusive Markets did not appear to operate from the location it has publicly registered, suggesting it may not be maintaining a legitimate local office. This absence makes it more difficult for regulatory authorities or affected investors to hold the company accountable should disputes or irregularities arise.

WikiFX assigns brokers a trust score based on a variety of factors, including regulation, corporate transparency, and user feedback. While Exclusive Markets is technically regulated, the combination of its offshore licence and the lack of a verifiable office undermines its trustworthiness in the eyes of many.

Investors are urged to exercise caution and conduct thorough due diligence before engaging with brokers, especially those licensed offshore or operating in jurisdictions with limited oversight. WikiFX‘s recommendation is clear: traders should make informed decisions based on a complete assessment of a broker’s regulatory status, operational transparency, and physical presence.

In an industry where unregulated or loosely regulated entities could cause significant financial harm, these red flags should not be taken lightly. Traders must remain vigilant, question what lies behind a broker's glossy website, and seek solid proof of legitimacy before making any commitments.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

AssetsFX Scam Alert: 5 Troubling Signs

Forex trading has become a critical game now because of advancements in technology. Due to this Unfortunately, scam brokers have also entered in the Forex market. Therefore, you need to stay alert. This article aims to warn all traders and investors. Read carefully and stay aware.

Forex4Money: Where Your Money Goes In, But Never Comes Out!

Discover how Forex4Money traps investors with fake profit promises and blocked withdrawals. Read real complaints and protect yourself from this unregulated forex scam.

Forex Success Stories: Lessons You Can Use to Win

There can be many ups and downs even for the world’s best forex traders. However, they remain undeterred in their vision to overcome the challenges that come their way. That’s why they form part of forex success stories that continue to inspire generations. One can inherit some lessons to be among successful currency traders. In this article, we will be sharing the lessons you can use to be successful in forex trading.

What are Indian Traders saying about MINTCFD?

MINTCFD is an India-based broker. It's important to note that independent watchdogs have issued scam alerts against the broker. They label MintCFD as risky and possibly fraudulent. In this Article, we will tell you the red flags of MINTCFD to protect your money

WikiFX Broker

Latest News

Interactive Brokers Expands Forecast Contracts to Europe

CNBC's Inside India newsletter: Why an India-U.K. trade deal does not make U.S.-India agreement any easier

Fraud Alert: 5 Issues You Might Face with Binomo

OpenAI spearheads one of Europe's biggest data centers with 100,000 Nvidia chips

Silver in Correction Mode: Navigating the Precious Metal’s Pullback

Webull Pay Reviews 2025: Details Compared

Doctor Trapped by 520% Profit Promise, Loses RM8.7 Million

CVS shares pop on earnings beat and outlook, as retail pharmacy and insurance units improve

Robinhood Gains 2.3M New Accounts, Platform Assets Close to $280B

Amazon earnings primer: Why AI and tariffs are key to the second quarter

Currency Calculator