简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Markets Stabilize After Powell Dismissal Fears Ease, Trade Policy in Focus

Abstract:Key Takeaways:Rumors of Powells potential dismissal rattled markets and briefly undermined confidence in the dollar.The greenback pared losses after Trump denied the move, while Wall Street reversed c

Key Takeaways:

Rumors of Powells potential dismissal rattled markets and briefly undermined confidence in the dollar.

The greenback pared losses after Trump denied the move, while Wall Street reversed course to end the day higher.

Trump softened rhetoric on China and signaled global tariff plans, extending his protectionist stance to over 150 countries.

Market Summary:

U.S. markets experienced heightened volatility Thursday following reports that President Trump had privately explored the possibility of removing Federal Reserve Chair Jerome Powell. According to sources familiar with the discussions, the President had gauged Republican lawmakers support for the move, sparking immediate concerns over central bank independence and potential destabilization of the U.S. financial framework.

The initial reaction saw risk assets wobble and the dollar weaken before markets recovered following Trumps subsequent denial. The President dismissed the speculation as “fake news,” stating a Powell dismissal before term-end was “highly unlikely.” Wall Street ultimately closed in positive territory as the clarification eased institutional concerns, while the greenback trimmed its earlier declines.

Analysts warned that any forced ouster of Powell could have longer-term dollar consequences, potentially undermining confidence in the currencys reserve status. The dollar faced additional pressure as Trump adopted a more conciliatory tone toward China, suggesting renewed efforts to restart trade negotiations. However, the administration simultaneously advanced its protectionist agenda, with plans to notify over 150 countries of impending tariffs between 10-15% on select imports.

The mixed signals on trade and monetary policy underscore ongoing market sensitivities to Washington‘s policymaking approach. With the Fed’s independence temporarily reaffirmed but trade uncertainty persisting, investors remain attuned to potential policy shocks that could disrupt the current equilibrium.

Technical Analysis

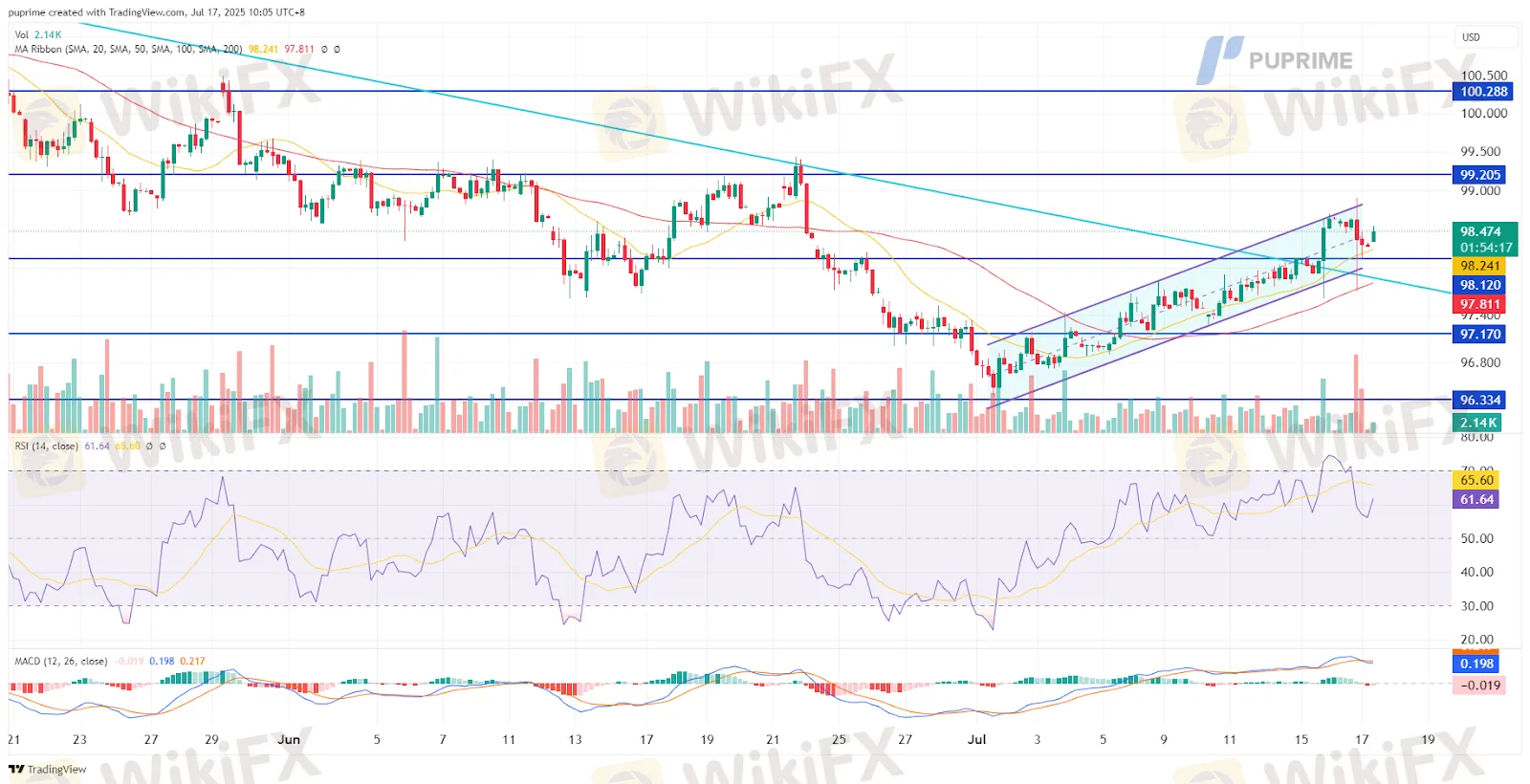

DXY H4:

The U.S. dollar posted a volatile session on Tuesday, with the Dollar Index (DXY) swinging more than 1% intraday. Despite the heightened volatility, technical price action continues to suggest a bullish bias for the greenback.

The index has decisively broken above a long-term downtrend resistance that had kept price action capped in a lower-high formation since the start of the year. The breakout has shifted the broader structure, placing the DXY within a defined uptrend channel, a signal of solid underlying bullish momentum.

Momentum indicators reinforce the positive outlook. The Relative Strength Index (RSI) is hovering near the overbought zone, reflecting persistent buying pressure. Meanwhile, the MACD has crossed above the zero line and continues to edge higher—both indicators aligning with the bullish trend.

Barring any major fundamental shift, the dollar appears well-positioned to extend gains in the near term.

Resistance Levels: 99.20, 100.30

Support Levels: 98.15, 97.20

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

What WikiFX Found When It Looked Into Vestrado

Is the Forex Bonus a Genuine Perk or Just a Gimmick?

eToro Joins Hands with Premiership Women’s Rugby

OctaFX Was Fined $37,000 for Operating Without a License

Hantec Financial: A Closer Look at Its Licenses

Saxo Bank Fined €1 Million by AMF Over Compliance Failures During IT Migration

CySEC Flags Two Unlicensed Investment Platforms: greymax.net and finotivefunding.com

Hantec Markets Appoints New Executives for Growth in Dubai

Olymptrade Under Fire – Fraud Allegations and Investor Outrage

GoPro, Krispy Kreme join the meme party as Wall Street speculation ramps up

Currency Calculator