简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Think Twice Before Choosing UC Markets –Know the Risks

Abstract:Forex trading has become increasingly complex and risky, especially for newcomers. While the foreign exchange market still offers legitimate opportunities for traders and investors, but investment scams have now become common. Fake brokers are widespread, and spotting them can be extremely difficult . The only way to safeguard your capital is to stay informed and alert. In this article, we’ll break down the red flags of UCMarkets and explain why you should avoid it .

Forex trading has become increasingly complex and risky, especially for newcomers. While the foreign exchange market still offers legitimate opportunities for traders and investors, but investment scams have now become common. Fake brokers are widespread, and spotting them can be extremely difficult . The only way to safeguard your capital is to stay informed and alert. In this article, well break down the red flags of UCMarkets and explain why you should avoid it .

1. Ghost Presence

One of the biggest red flags is that UCMarkets has almost no online presence. When we searched for it on Google, we couldn't find any information — no verified reviews, no detailed articles, and no real discussions in trading forums. This lack of visibility makes it clear that the broker may not be operating legitimately.

We also checked WikiFX, a well-known platform for verifying brokers. There, we found a link to UCMarkets‘ official website. While the website looks professional, it seems too perfect — and that can be a warning sign. This kind of hidden behavior is common with scam brokers. Honest and reliable brokers are easy to find online and don’t hide from the public.

2. Lack of Credible Regulation

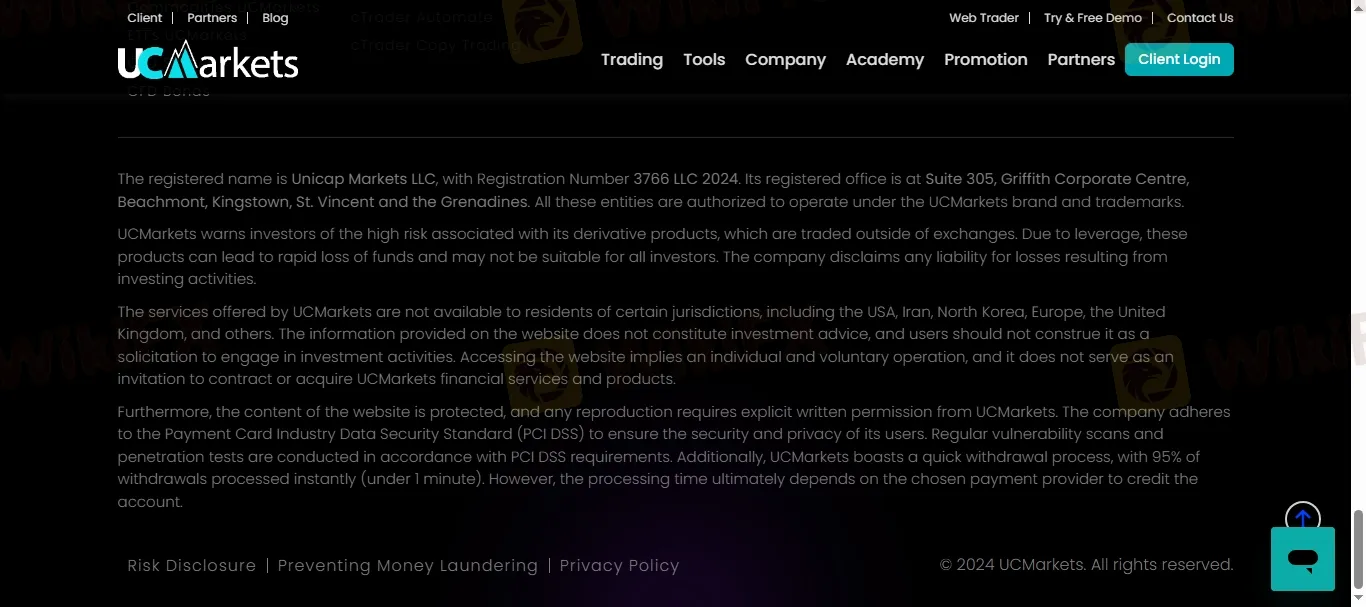

UCMarkets claims to be regulated by the Financial Services Authority (FSA) of St. Vincent and the Grenadines. However, this is not a trusted or reputable regulatory body when it comes to financial services.

If a broker isnt regulated by a reputable authority, such as

- FCA (UK – Financial Conduct Authority)

- ASIC (Australia – Australian Securities and Investments Commission)

- SEC (USA – Securities and Exchange Comission) etc.

You have no legal protection, no transparency, and no guarantees that your funds are safe.

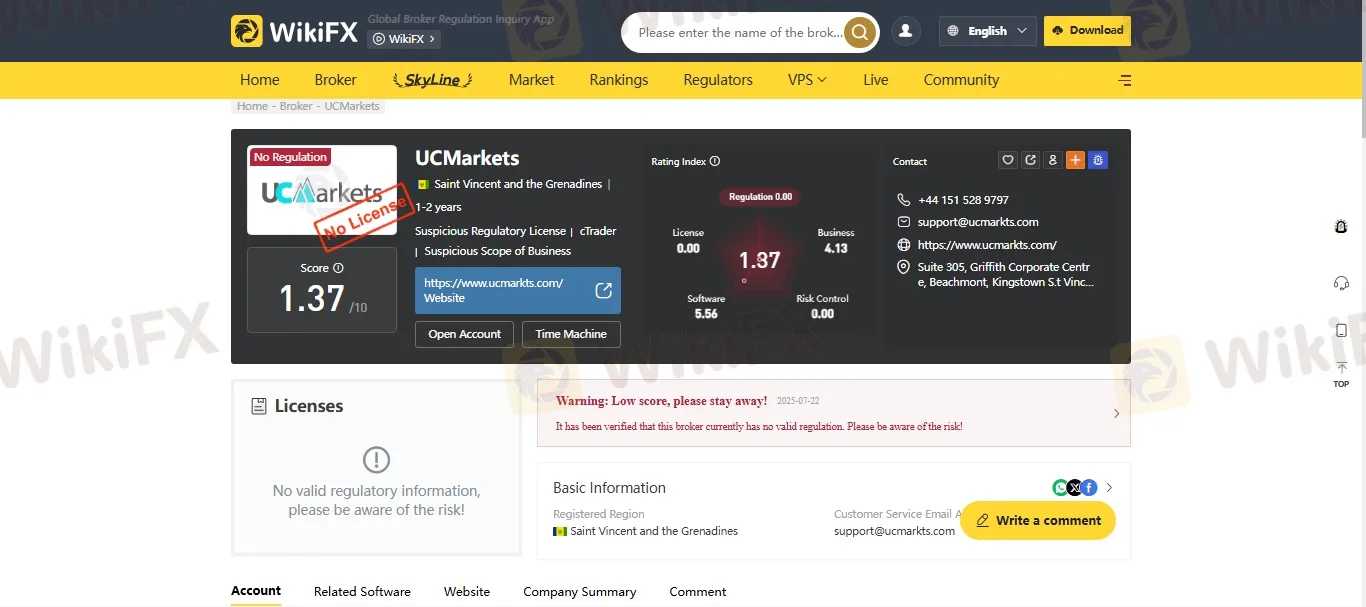

3. Extremely Low Trust Score

When a broker has no online reputation, one of the best ways to evaluate it is through rating platforms.

According to WikiFX, UCMarkets has a low score of 1.37 out of 10 which is a critical red flag. A score below 2 suggests severe trust issues. A rating of 1.37 is a guaranteed warning sign that this broker is unsafe for trading or investment.

Read this Article too- www.wikifx.com/en/newsdetail/202507228674613426.html

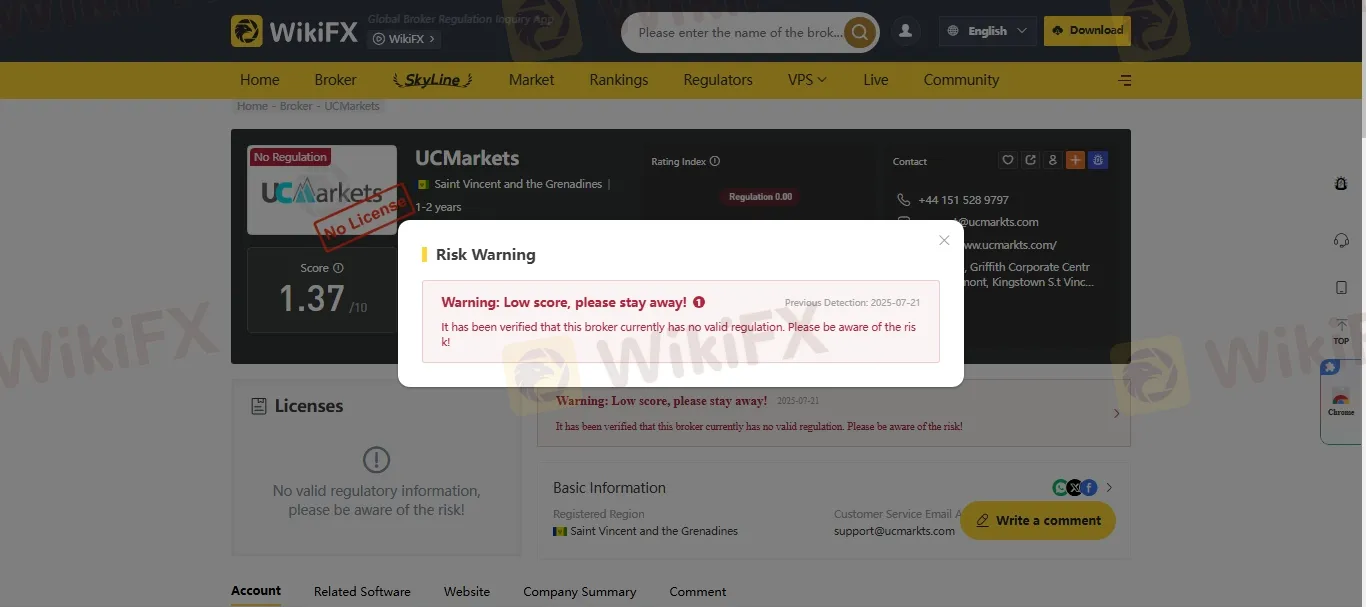

4. Official Warning from WikiFX

Our investigation revealed that WikiFX has issued an official warning against UCMarkets. The warning is direct and clear:

Warning: Low score, please stay away!

It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

5. Unverifiable Corporate Information

UCMarkets operates under the entity name Unicap Markets LLC, claiming an address in St. Vincent & the Grenadines. However, our search of official business registries did not return any verifiable records for the company. This kind of inconsistency raises serious questions:

Legitimate brokers are transparent about their registration, ownership, and physical office locations. Failure to verify these basics is another strong sign of fraud.

Join WikiFX Community by following steps

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. Congratulations! You have Joined the Group

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Startling Differences Between Hedging and Arbitrage

The two risk management investment tools - hedging vs arbitrage - have been helping investors achieve their respective financial goals. Explore this comparision to understand their functionalities, the investment purpose they serve, the risk attached, and several other aspects.

Why Octa Is the Ideal Broker for MetaTrader 4 & 5 Users

Octa is a well-reputed, renowned, and award-winning broker in the forex market. It offers many exclusive features to investors, such as educational resources, a wide range of assets, dedicated customer support, and access to popular trading platforms like MetaTrader 4 and 5.

Dubai Police Arrests 4 People in Connection with High and Quick Profits Online Trading Scam

Dubai Police have arrested four individuals involved in defrauding many investors via fake online trading schemes that promised high and quick returns. Check out the arrests, international connections, and more in this story.

Spanish Regulator, CNMV Alerts Investors against 11 Scam Brokers

Spain’s Financial regulator, CNMV (Comisión Nacional del Mercado de Valores) CNMV has issued warnings against 11 forex brokers operating without proper authorization.

WikiFX Broker

Latest News

What WikiFX Found When It Looked Into Vestrado

Is the Forex Bonus a Genuine Perk or Just a Gimmick?

eToro Joins Hands with Premiership Women’s Rugby

OctaFX Was Fined $37,000 for Operating Without a License

Hantec Financial: A Closer Look at Its Licenses

Saxo Bank Fined €1 Million by AMF Over Compliance Failures During IT Migration

CySEC Flags Two Unlicensed Investment Platforms: greymax.net and finotivefunding.com

Hantec Markets Appoints New Executives for Growth in Dubai

Olymptrade Under Fire – Fraud Allegations and Investor Outrage

GoPro, Krispy Kreme join the meme party as Wall Street speculation ramps up

Currency Calculator