简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EVA Markets: Where You Can Only Deposit But Can't Withdraw

Abstract:EVA Markets is becoming the nemesis for forex investors with complaints about withdrawal denials, trading manipulation, and pressure for more deposits, making headlines. Here's the exposure story of EVA Markets, where its investors have given it a bad review. Check it out!

EVA Markets is becoming the nemesis for forex investors who trust it for wealth creation. Massive complaints about withdrawal denials, trading manipulation, and pressure for more deposits put this Comoros-based forex broker in a bad light. After reading the trader complaints, we thought about exposing EVA Markets, which has been operating for a year or two in the forex landscape.

Complaints That Got Us Noticing EVA Markets

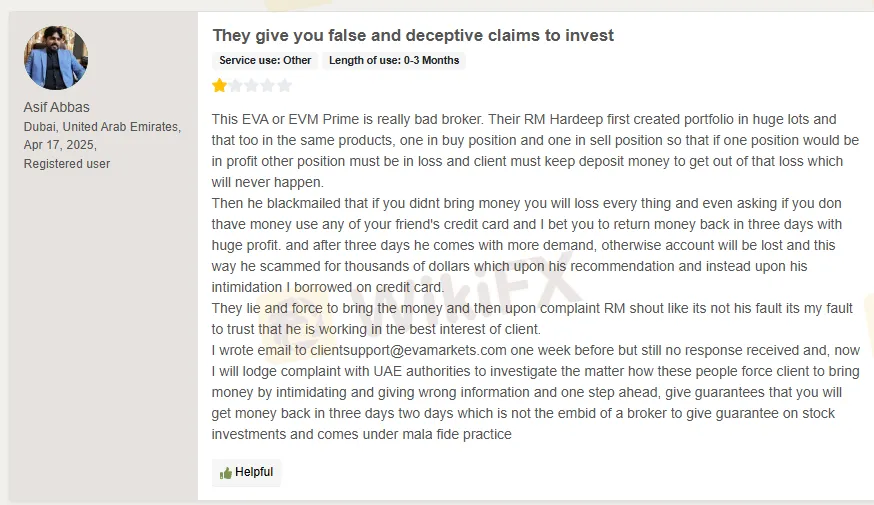

Fake Claims, Threatening Calls, Loss in Trades

These three traits are synonymous with EVA Markets. Often, its executives would persuade investors to invest under the pretext of false claims. The executives would manipulate trading to show losses for the investors so that they would not have the capital to withdraw. They also threaten investors on the call, bringing so much disrepute to this forex broker. Cant believe these words? Here is the snapshot!

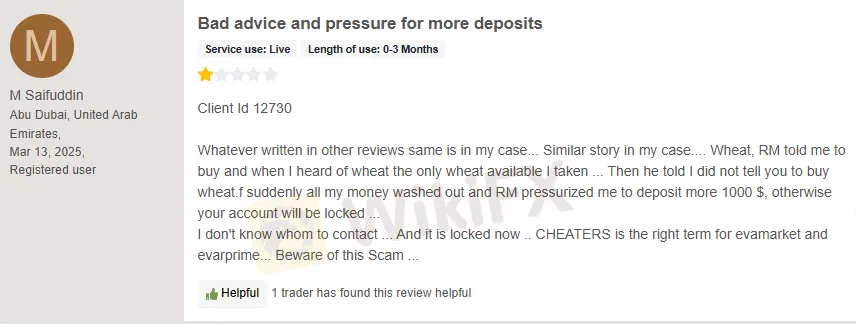

Increased Pressure on Investors for Deposits Despite Losses

Telling investors to buy and then denying it is increasingly becoming typical of EVA Markets. This glitch results in losses for investors. Instead of owning the mistake, the company executives pressurize investors to deposit more. In its absence, they claim that the account will be blocked. Feel for the pain this customer witnessed due to the poor customer service rendered by EVA Markets.

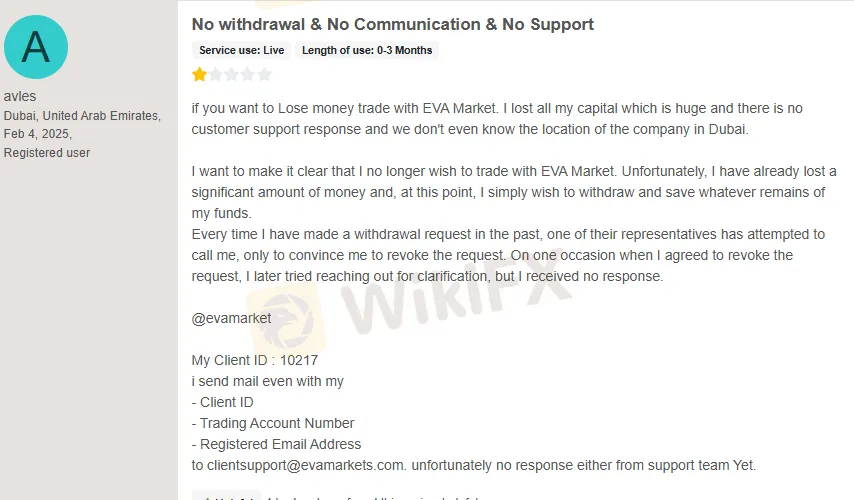

No Communication, No Support, No Withdrawals

Investors have undeniably lost incredible capital with EVA Markets. They don‘t receive withdrawals as their request only sees REJECTION. But what’s more concerning is that investors are not able to trace the location of this forex broker. Read these sharp words from the investor.

EVA Markets Trains Its Executives on How to Dupe Investors

EVA Markets follows a strategic approach of training its executives to dupe investors. The executives constantly push investors to invest, show a portion of it as profit, and bring in more deposits, which leads to losses for them. It is a vicious cycle investors have been trapped in. The lack of customer support service only makes investors worried about capital safety. Check this comment that evokes fear of investing in EVA Markets.

Scanning EVA Markets from a Close Lens

EVA Markets is a bad name because it is not authorized by any financial regulator. Being an unregulated entity, it has escaped the compulsion to share operational details with the regulator. As a result, it has been successful in scamming investors. As it is red-flagged for illegal conduct of forex business, WikiFX, the go-to app for the forex broker regulation inquiry, has assigned it only 1.84 out of 10.

Something Cool. Something Exciting. Something Rewarding.

Join WikiFX Masterminds - Where You Know Whats Driving the Forex Market - by scanning this QR code.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

7 Common Mistakes Made by Indian Forex Traders

Forex trading has become very popular among Indian traders in recent years. Every month, thousands of new traders join this market. But sadly, majority of them lose their hard-earned money because of their common mistakes. Which are these mistakes? Read below.

What Does PrimeXBT's Offshore Regulatory Status Really Mean?

Understanding PrimeXBT's offshore regulatory status, its implications, and what it means for traders looking for transparency and reliability in their investments.

iFourX: So Many Red Flags You Can’t Ignore

Forex trading has become difficult nowadays due to the frequent frauds occurring every day. You can’t blindly trust any broker . They may appear genuine and authorized but end up being scams. That’s why it’s more important to stay aware. To stay alert and informed, you need to know about a particular FX broker called iFourX and recognize its red flags.

Five Unauthorised Brokers Warned by the FCA

UK’s watchdog, the Financial Conduct Authority (FCA), recently issued a fraud alert against brokers who are operating without a license but still offering financial services. The FCA has identified these scam brokers and is warning the public not to engage with them. Check out the names of those brokers below.

WikiFX Broker

Latest News

Top Wall Street analysts recommend these dividend stocks for regular income

Stock futures rise as U.S.-EU trade deal kicks off a hectic week for markets: Live updates

Thailand-Cambodia War Pressures Thai Baht in Forex Market

Treasury yields tick lower as investors look ahead to Fed's interest rate decision

European stocks set to rise after the U.S. and EU strike trade agreement

Samsung Electronics signs $16.5 billion chip-supply contract; shares rise

Does XS.com Hold Leading Forex Regulatory Licenses?

Elon Musk confirms Tesla has signed a $16.5 billion chip contract with Samsung Electronics

Chile Bumps Up Copper Price Forecast and Flags Lagging Collahuasi Output

A breakthrough and a burden? What the U.S.-EU trade deal means for the auto sector

Currency Calculator