简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Breaks Above $3,400 as Equities Hit New Highs!

Ikhtisar:Over the past two weeks, both safe-haven and risk assets have surged—an unusual but increasingly common trend since 2020. This dual rally defies the analytical framework of the previous decade. More i

Over the past two weeks, both safe-haven and risk assets have surged—an unusual but increasingly common trend since 2020. This dual rally defies the analytical framework of the previous decade. More importantly, we observed that gold's rally yesterday moved in tandem with non-USD currencies, suggesting the U.S. Dollar Index (DXY) still plays a crucial role in gold's future trajectory.

The DXY dropped from 98.21 to a low of 97.78. EUR/USD climbed past the 1.17 level, while USD/JPY retreated below the 148 mark. When viewed independently, the U.S. equity market appears driven by a FOMO rebound rally. Fund managers—according to the latest FMS report—have notably increased allocations to U.S. assets, driven by stellar Q2 earnings and a lack of incentives to sell U.S. equities.

In a market session that was neither turbulent nor headline-heavy, the dollar experienced a notable pullback. We currently interpret this as a technical correction rather than the start of a bearish trend for the dollar index.

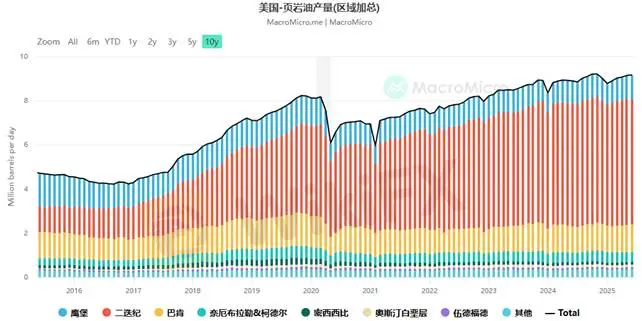

Turning to commodities, oil prices have been steadily declining. We believe the market is poised to begin pricing in narratives of weakening end-user demand and a potential recession. The traditional summer peak season for oil demand is faltering. Meanwhile, OPEC+ is reportedly preparing for another output increase, with Bloomberg citing a preliminary plan to raise production by 550,000 barrels per day by September.

The International Energy Agency (IEA) notes that global oil inventories are growing at a rate of 1 million barrels per day, projecting a 1.5% supply surplus in Q4 of this year.

However, the UAEs Energy Minister, during a conference in Vienna, stated that despite several months of increased production, no significant inventory buildup has been observed—suggesting the market is still absorbing the added supply.

For Middle Eastern producers, the cost of producing a barrel of oil is just $6. This low production cost gives OPEC+ flexibility to continue boosting output into October. From their perspective, maintaining elevated oil prices may not be a priority.

(Chart 1: WTI Crude Futures Prices; Source: CNBC)

(Chart 2: U.S. Shale Oil Production Remains Elevated; Source: MacroMicro)

The decline in commodity prices will contribute to disinflationary pressure. If end-user demand underperforms in the second half of the year, even if rate cuts are initiated, safe-haven capital could flow back into the dollar—much like in 2022—leading to a broad sell-off across all asset classes except the greenback.

This volatility could persist for at least one quarter, potentially longer. Our outlook on gold has shifted from bearish to neutral in the short term, but we remain cautious on the medium-term outlook due to uncertainties surrounding the U.S. Dollar Index.

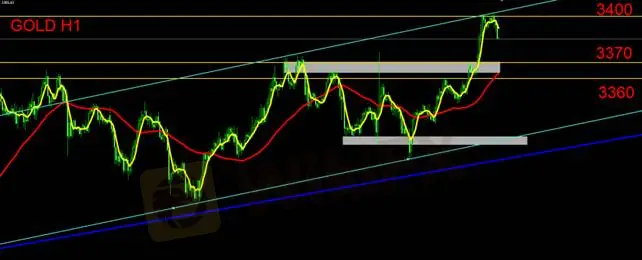

Technical Outlook on Gold

On the hourly chart, gold displays a two-stage rally, forming a rising channel. If this channel structure holds, investors should watch for a pullback after prices broke above $3,400 and approached the upper channel boundary. Key support levels to watch are $3,370 and $3,360. If these levels fail to hold, gold may retreat further to test the lower edge of the channel.

Intraday Strategy: If prices fail to break above the $3,404 level on the next attempt, short-term selling within the channel may be favored. Given the current setup, we believe short positions may hold more advantage in the near term.

Support: 3,370 / 3,360

Resistance: 3,400

Risk Disclaimer: The views, analysis, research, pricing, or other information provided here are intended as general market commentary and do not represent the views of this platform. All readers are advised to assess their own risk and trade cautiously.

Disclaimer:

Pandangan dalam artikel ini hanya mewakili pandangan pribadi penulis dan bukan merupakan saran investasi untuk platform ini. Platform ini tidak menjamin keakuratan, kelengkapan dan ketepatan waktu informasi artikel, juga tidak bertanggung jawab atas kerugian yang disebabkan oleh penggunaan atau kepercayaan informasi artikel.

WikiFX Broker

Berita Terhangat

Korban 55.548 KLIEN ! Regulator AMF 2025 Menjerat Broker Forex Saxo Bank A/S Dengan Hukuman Berat

TERUNGKAP ! Sindikat 6 Broker Bodong Trading Forex Scam Rugikan Trader Hingga Jutaan Dolar

Cara MAKSIMAL Memanfaatkan Fluktuasi Forex Rate Untuk Profit CFD Currency Trading 2025

Event WikiFX BERHADIAH 2025 ! Berbagi Kesalahan Trading & Proses Bertumbuh

MENJEBAK 3 Trader Indonesia ! Broker Forex Tag Markets Ltd Kasus Promosi NDB dan Withdrawal 2025

Kelebihan vs Kekurangan Program Broker Forex Rebate 2025 Bagi Trader Online Indonesia

Wajib Dicatat? Peluang vs Risiko: Masa-Masa Kritis Foreign Exchange Market Hours Saat Trading Online

Nilai Tukar