简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Report: Five Forex Brokers with No Spread

Abstract:Zero spread accounts offer traders the opportunity to execute tight, cost-efficient trades. By eliminating the traditional bid-ask spread and charging a small commission per lot, these accounts suit scalpers, high-frequency traders, and strategy-focused investors. In this article, we offer five regulated brokers with strong WikiFX scores. These brokers provide traders with zero-spread accounts.

Zero‑spread accounts offer traders the opportunity to execute tight, cost-efficient trades. By eliminating the traditional bid-ask spread and charging a small commission per lot, these accounts suit scalpers, high-frequency traders, and strategy-focused investors. In this article, we offer five regulated brokers with strong WikiFX scores. These brokers provide traders with zero-spread accounts.

IC Markets (Raw Spread Account)

WikiFX Score: 9.10/10

Regulation: ASIC (Australia), CySEC (Cyprus)

Zero‑Spread Feature: Raw Spread accounts start from 0.0 pips on major currency pairs, with an average EUR/USD spread of 0.1 pips. A commission of USD 3.50 per lot per side applies, delivering ultra-tight pricing ideal for scalping and EAs.

Advantages of IC Markets

- Market Connectivity: Aggregates liquidity from 25+ institutional venues.

- Execution Speed: Servers in Equinix NY4 for minimal latency.

Platform Support: MT4, MT5, and cTrader available.

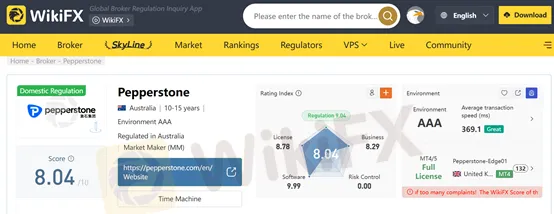

Pepperstone (Razor Account)

WikiFX Score: 8.04/10

Regulation: ASIC (Australia), FCA (UK), CySEC (Cyprus), DFSA (UAE), CMA (Kenya), SCB (Bahamas)

Zero‑Spread Feature: Razor accounts offer raw spreads from 0.0 pips on forex pairs. Commission-based pricing begins at USD 3.50 per 100,000 units on MT4/MT5, ensuring transparent costs for high-frequency traders.

Advantages of Pepperstone

- Global Footprint: Offices in Melbourne, London, Düsseldorf, and beyond.

- Platform Variety: Native app, MT4, MT5, TradingView, cTrader.

- Volume Rebates: Professional clients can earn commission rebates.

Tickmill (Raw Account)

WikiFX Score: 8.93/10

Regulation: FCA (UK), CySEC (Cyprus), FSCA (South Africa), DFSA (Dubai), FSA (Seychelles)

Zero‑Spread Feature: Raw accounts start from 0.0 pips on major FX pairs, with a commission of USD 3.00 per side per standard lot. Ideal for scalpers and algorithmic traders seeking minimal transaction costs.

About Tickmill

- Fast Execution: Average trade execution in 0.15 seconds.

- Client Safety: Negative balance protection and fund segregation.

Education & Tools: Webinars, calculators, and signal center.

FP Markets (Raw Account)

WikiFX Score: 8.88/10

Regulation: ASIC (Australia), CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles), CMA (Kenya), FSC (Mauritius), SCB (Bahamas)

Zero‑Spread Feature: Raw accounts offer spreads from 0.0 pips on major pairs, with commissions starting at USD 3.00 per lot per side. Leverage up to 1:500 enhances flexibility for active traders.

About FP Markets

- Award‑Winning: Voted Best Value Broker six years running.

- Deep Liquidity: Direct connections to top-tier banks.

- Trading Suite: MT4, MT5, cTrader, Iress, and proprietary tools.

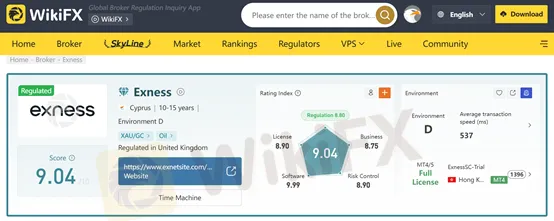

Exness (Zero Account)

WikiFX Score: 9.04/10

Regulation: FCA (UK), CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles), CBCS (Curacao & Sint Maarten)

Zero‑Spread Feature: Zero accounts deliver 0.0 pip spreads on the top 30 instruments, with commissions from USD 0.05 per side per lot. Market execution with no requotes ensures precision.

Why Choose Exness?

- Unlimited Leverage: Up to 1: Unlimited (subject to local rules).

- Fast Withdrawals: 24/7 automated processing.

Diverse Instruments: Forex, metals, crypto, energies, indices, stocks.

Q&A Section

What are the advantages of a zero‑spread account?

Zero‑spread accounts provide cost certainty, tighter entries, and ideal conditions for scalping and high-frequency trading, as spreads start from 0.0 pips.

Are zero‑spread accounts suitable for beginners?

While the tight pricing benefits all traders, beginners should understand commission models and practice risk management to avoid overleveraging.

Can I use automated trading on zero‑spread accounts?

Yes. All five brokers support EAs and algorithmic strategies on MT4/MT5, with Tickmill and IC Markets offering particularly fast execution.

Conclusion

Choosing a zero‑spread broker with high WikiFX ratings and robust regulation can significantly enhance trading efficiency and risk management. IC Markets, Pepperstone, Tickmill, FP Markets, and Exness each offer compelling zero‑spread accounts.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Olymptrade Under Fire – Fraud Allegations and Investor Outrage

The message is loud and clear for Olymptrade - Get your act RIGHT or continue to face fraud allegations and investor outrage. With investor complaints refusing to stop, Olymptrade has all but lost trust and goodwill.

Busted! 5 Brokers Blacklisted by the FCA

The FCA (Financial Conduct Authority) warns people about unauthorised brokers—operating without a proper license. If a broker is unregistered, you have no legal protection or refunds if they take your money or fail to handle it properly. FCA has recently blacklisted.5 scam brokers. Checkout the List Below.

Is the Forex Bonus a Genuine Perk or Just a Gimmick?

Have you received a forex bonus offer from a broker? Wondering whether it is a pure marketing ploy to make you a client? Your doubt makes sense! Explore this story where we have uncovered details regarding forex deposit bonus, no deposit bonus, and other types.

FXnice Review – A Trail of Scams, Poor Support & Misleading Strategies

FXnice, surprisingly, is not proving nice for forex traders all over. Traders have been requesting the company officials to allow them to withdraw their funds. However, these officials provide them a false reason, i.e., unverified accounts for withdrawal denials. Inaccurate technical tools and incompetent analysts further add to the investors' woes. Dive into this much-awaited exposure story on FXnice.

WikiFX Broker

Latest News

Japan stocks jump over 3% as Trump announces trade deal; broader Asia markets also rise

European stocks set to rally at the open as U.S.-Japan trade deal boosts global market sentiment

CySEC Flags Two Unlicensed Investment Platforms: greymax.net and finotivefunding.com

Shares of department store Kohl's surge 30% in wild trading

Just be yourself' is bad advice, says expert—here's what successful people do instead

Opendoor shares are surging again as hyped real estate stock leads meme rally revival

WikiFX Report: Five Forex Brokers with No Spread

MFSA Warns of Digital Market Mining Scam: Alchemy Markets Clone

Alchemy Markets Launches Seamless TradingView Integration

EC Markets Expands with New Office in Mauritius

Currency Calculator