Durable Goods Orders (Ex-Transports) Beat Expectations In June

บทคัดย่อ:After surging higher in May, on the back of huge Boeing aircraft orders, US durable goods orders wer

After surging higher in May, on the back of huge Boeing aircraft orders, US durable goods orders were expected to tumble back to earth in preliminary June data... and they did.

Durable Goods Orders plunged 9.3% MoM (slightly better than the -10.7% MoM expected) - the biggest drop since the COVID lockdowns. But as the chart below shows, it is a wildly noisy time series, almost entirely due to the lumpiness of aircraft orders...

Source: Bloomberg

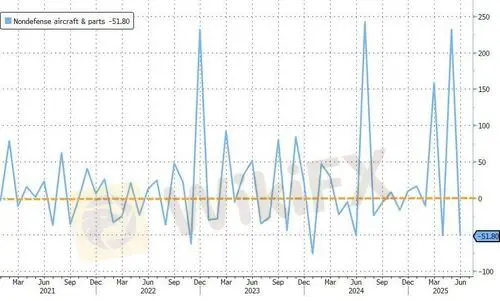

Thanks to a swing from a 230% MoM rise to a 50% MoM decline in non-defense aircraft orders...

Source: Bloomberg

Excluding the noise of Boeing orders, the data was actually solid with a 0.25% MoM increase (better than the 0.1% rise expected) in durable goods orders (ex-Transports),pushing YoY orders uo 2.23%

Source: Bloomberg

Adding to the confusion, the value of core capital goods orders, a proxy for investment in equipment excluding aircraft and military hardware, decreased 0.7% last month after an upwardly revised 2% gain in May

Capital goods shipments rose 0.4%, excluding defense and commercial aircraft, better than the +0.2% expected, adding to Q2 GDP growth hopes.

A very mixed picture from a generally considered 'secondary' economic indicator... and this the market reaction is muted to say the least.

ข้อจำกัดความรับผิดชอบ:

มุมมองในบทความนี้แสดงถึงมุมมองส่วนตัวของผู้เขียนเท่านั้นและไม่ถือเป็นคำแนะนำในการลงทุน สำหรับแพลตฟอร์มนี้ไม่รับประกันความถูกต้องครบถ้วนและทันเวลาของข้อมูลบทความ และไม่รับผิดชอบต่อการสูญเสียใด ๆ ที่เกิดจากการใช้ข้อมูลในบทความ

WikiFX โบรกเกอร์

ATFX

KVB

FXTRADING.com

FOREX.com

Vantage

Saxo

ATFX

KVB

FXTRADING.com

FOREX.com

Vantage

Saxo

WikiFX โบรกเกอร์

ATFX

KVB

FXTRADING.com

FOREX.com

Vantage

Saxo

ATFX

KVB

FXTRADING.com

FOREX.com

Vantage

Saxo

ข่าวล่าสุด

เชื่อหรือไม่!? เทรดเดอร์คนแรกของโลกอาจเป็นชาวบาบิโลน

มือใหม่ 90% ไม่เคยรู้! MT4 กับ MT5 ต่างกันตรงไหน ระวังเทรดพังเพราะเลือกผิด

รีวิว ThinkMarkets ใช้แล้วเป็นยังไง? สำนักงานดูดีแล้วเทรดลื่นหรือเปล่า

รีวิว Headway ถอนเงินยากจริงหรือเปล่า ใครเคยใข้รีบบอกด่วน!

คำนวณอัตราแลกเปลี่ยน