简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What WikiFX Found When It Looked Into CORSA FUTURES

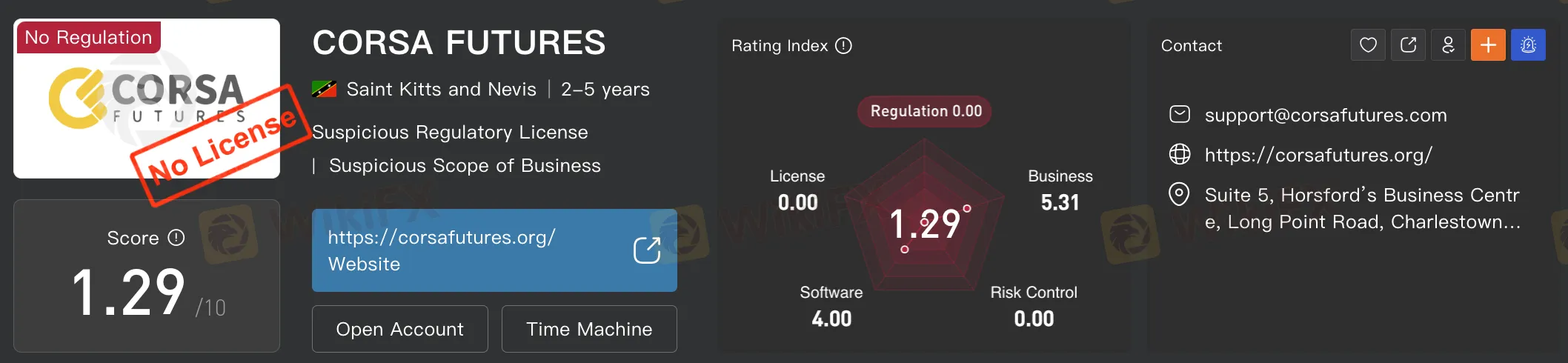

Abstract:Online trading is growing fast, but so are the risks. It's more important than ever to choose brokers that are transparent, regulated, and trustworthy. One broker raising concerns is CORSA FUTURES. According to WikiFX, a platform that checks broker credibility, CORSA FUTURES has a very low score of 1.29 out of 10. This low rating suggests serious issues with the broker's trustworthiness. Keep reading to learn more about this broker

Online trading is growing fast, but so are the risks of forex scams. It's more important than ever to choose brokers that are transparent, regulated, and trustworthy. One broker raising concerns is CORSA FUTURES. According to WikiFX, a platform that checks broker credibility, CORSA FUTURES has a very low score of 1.29 out of 10. This low rating suggests serious issues with the broker's trustworthiness and increases the risk of falling victim to a forex scam.

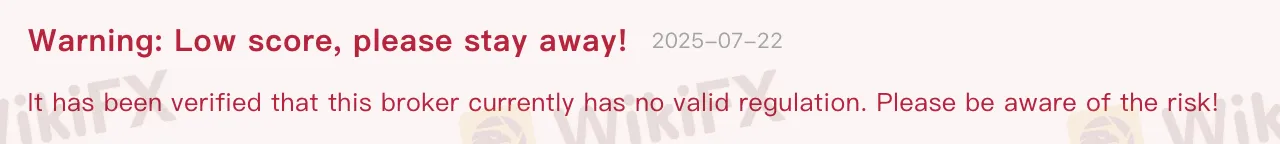

One major concern is that CORSA FUTURES is not regulated. This has been confirmed by independent sources. Regulation is essential because it protects traders. It makes sure brokers follow fair rules, keep client funds safe, and offer ways to resolve problems.

Without a proper license, CORSA FUTURES operates outside of these protections. This can lead to problems like unauthorized charges, slow or blocked withdrawals, and no clear way to handle complaints, which are classic signs of forex scams.

CORSA FUTURES is registered in Saint Kitts and Nevis, a small offshore location known for having weak financial rules. While it's legal to register there, these places usually dont require brokers to follow strict standards. This can mean poor fund protection, low transparency, and more risk of forex scams.

Where a broker is based matters. Offshore registration is often a warning sign. In this case, it adds to the suspicion that CORSA FUTURES may be linked to forex scam activity.

The low WikiScore of 1.29/10 reflects several problems, including a lack of regulation, negative customer feedback, poor software, and weak risk management. This score shows that the broker is not seen as reliable and may be engaging in forex scams.

Some traders have also reported issues like not getting their money back and unhelpful support. These are common complaints in known forex scams.

CORSA FUTURES shows multiple warning signs: no license, offshore registration, low scores, and negative feedback. While not every unregulated broker is a scam, these issues combined make CORSA FUTURES a high-risk choice.

To protect your money, always choose brokers that are regulated by trusted authorities like the FCA (UK), ASIC (Australia), or CySEC (Cyprus). Unregulated brokers can lead to big losses, with little chance of recovery.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Olymptrade Under Fire – Fraud Allegations and Investor Outrage

The message is loud and clear for Olymptrade - Get your act RIGHT or continue to face fraud allegations and investor outrage. With investor complaints refusing to stop, Olymptrade has all but lost trust and goodwill.

Busted! 5 Brokers Blacklisted by the FCA

The FCA (Financial Conduct Authority) warns people about unauthorised brokers—operating without a proper license. If a broker is unregistered, you have no legal protection or refunds if they take your money or fail to handle it properly. FCA has recently blacklisted.5 scam brokers. Checkout the List Below.

Is the Forex Bonus a Genuine Perk or Just a Gimmick?

Have you received a forex bonus offer from a broker? Wondering whether it is a pure marketing ploy to make you a client? Your doubt makes sense! Explore this story where we have uncovered details regarding forex deposit bonus, no deposit bonus, and other types.

FXnice Review – A Trail of Scams, Poor Support & Misleading Strategies

FXnice, surprisingly, is not proving nice for forex traders all over. Traders have been requesting the company officials to allow them to withdraw their funds. However, these officials provide them a false reason, i.e., unverified accounts for withdrawal denials. Inaccurate technical tools and incompetent analysts further add to the investors' woes. Dive into this much-awaited exposure story on FXnice.

WikiFX Broker

Latest News

MFSA Warns of Digital Market Mining Scam: Alchemy Markets Clone

Alchemy Markets Launches Seamless TradingView Integration

Drawdown in Forex Trading

WikiFX Report: Five Forex Brokers with No Spread

Two Candle Patterns

EC Markets Expands with New Office in Mauritius

What WikiFX Found When It Looked Into CORSA FUTURES

Dutch semiconductor giant ASMI drops 9% after lumpy' order intake

What WikiFX Found When It Looked Into Vestrado

Is the Forex Bonus a Genuine Perk or Just a Gimmick?

Currency Calculator